A new agreement brings Azerbaijan and Turkmenistan closer than ever since the collapse of the Soviet Union. It also brings a Trans-Caspian Pipeline, which could transport Turkmen gas to Europe, within reach.

This article was originally published on Novastan’s German website on 16 February 2021.

After decades of disagreement over the use of oil and gas reserves in the Caspian Sea, the presidents of Azerbaijan and Turkmenistan signed a memorandum of understanding (MoU) via video conference on 21 January 2021, Eurasianet reports. This temporarily ends a conflict between the two states that has been smouldering since the 1990s.

The main point of contention was an oil and gas field in the maritime border area between the two countries. The field, formerly known as “Kapaz” in Azerbaijan and “Serdar” in Turkmenistan, has now symbolically been renamed “Dostlug” or “Dostluk”, meaning “friendship”.

Want more Central Asia in your inbox? Subscribe to our newsletter here.

The field is located about 184 km east of Azerbaijan and 104 km west of Turkmenistan under the Caspian Sea and was discovered by Soviet scientists in 1986. Since then, as Eurasianet notes, it has been the cause of tensions between the two states. Azerbaijan drilled the first test well and subsequently declared its claim to the fossil fuels.

Turkmenistan, in return, insisted on the geographical location of the field with a closer proximity to the Turkmen mainland. The foundation for the new MoU was laid between the five littoral states Russia, Kazakhstan, Turkmenistan, Iran and Azerbaijan in 2018 during a summit on the legal status of the Caspian Sea. At that time, the parties agreed on the course of the sea’s borders and the rights of use.

Towards a Trans-Caspian pipeline

Details of the joint deal, such as the division of profits from the exploitation or logistical details, are not yet known. The exact size of the reserves of “Dostlug” is also unknown, but they are estimated at around 50 to 100 million tonnes of oil and 30 billion cubic metres of gas. Compared to other Turkmen and Azerbaijani reserves, the field is thus not of great economic significance, as Eurasianet notes. Azerbaijan, for example, has proven gas reserves of about 1.3 trillion cubic metres and Turkmenistan of 19.5 trillion cubic metres.

Much more significant are the political implications of the agreement. After a long period of political blockades, it opens up the possibility for a Trans-Caspian pipeline between Turkmenistan and Azerbaijan.

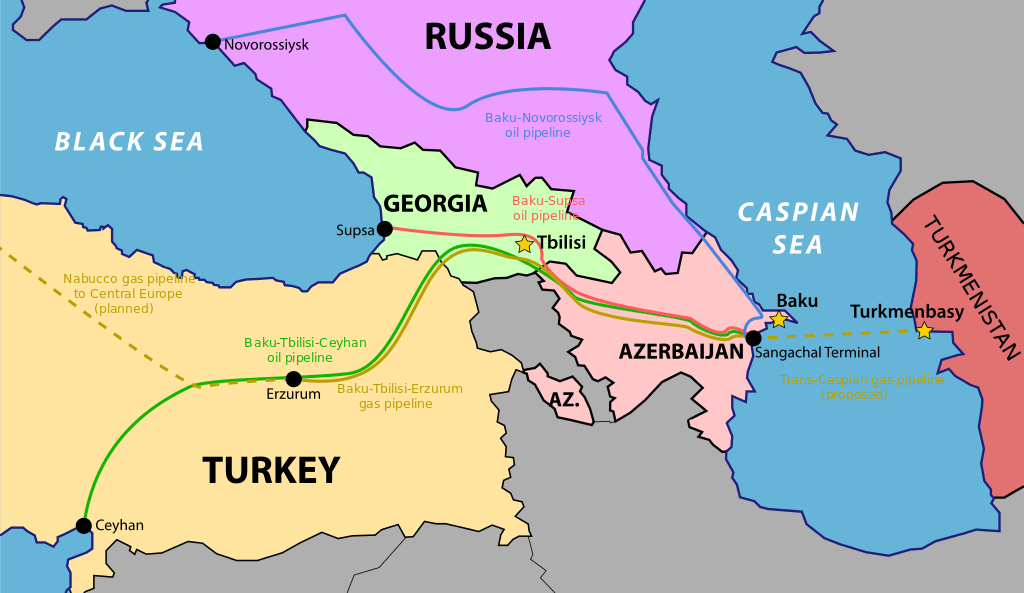

The long-planned pipeline through the Caspian Sea would provide a direct link between the Turkmen port city of Türkmenbaşy and the Azerbaijani oil terminal of Sanqaçal. This step would make it possible for Turkmenistan to export its extensive gas reserves to the European market via Azerbaijan for the first time.

Azerbaijan, in turn, could benefit from transit tariffs through the use of its pipeline systems and infrastructure. “The project will promote the improvement of energy security of our countries, as well as our neighbours” Azerbaijan’s president Ilham Aliyev said in reference to the 21 January agreement.

Connecting Turkmenistan to the European market

The planned Trans-Caspian route would connect Turkmenistan to the existing Baku-Tbilisi-Ceyhan (BTC) and South Caucasus pipelines. These transport oil and gas from the Caspian Sea via Georgia to Erzurum in central Anatolia and to the Turkish port of Ceyhan.

Azerbaijan has so far led the Southern Gas Corridor project, which delivers Caspian gas via Turkey, Greece, Albania and through the Adriatic Sea to Italy. The EU wants to bolster its energy security in this way in order to become less dependent on Russia, which has been its main supplier up until now. The first gas from this connection reached the European market on 31 December 2020.

Read more: Uzbekistan: towards greater cooperation with Iran?

Turkmenistan has so far exported its natural resources mainly to China and Russia. These export capacities have recently suffered from sharply falling oil prices and a drop in demand for gas during the Covid-19 pandemic.

With the new Trans-Caspian link, Turkmenistan could significantly expand its market and become less dependent on its current partners. The existing pipeline systems in the direction of Europe could easily be expanded to accommodate Turkmen gas in the future.

Questionable profitability under difficult conditions

After almost thirty years of dispute and a changed situation on the European gas market, however, it is questionable how large the EU’s demand for Turkmen gas still is today. Stanislav Pritchin, senior fellow at the Centre for Post-Soviet Researches at the Russian Academy of Sciences, said of the new connection: “Today, the competition on the European market makes it very difficult for the Trans-Caspian pipeline with new producing capacities in Turkmenistan to pay off reliably.”

There are also environmental concerns such as the European Green Deal, which intends to shape the EU into a CO2-free zone over the next thirty years. In the future, the European Development Bank will no longer support projects promoting fossil fuels, which puts public funding out of question, the researcher Marco Giuli noted. He added that European demand for gas will stabilise over the next decade and then decline sharply if the EU puts its climate neutrality goals into practice. It‘s “not a good context for a pipeline with 50 plus years life cycle,” he explained.

Last but not least, Turkmenistan’s attitude towards private financing faces criticism. According to the Institute for War and Peace Reporting, some Western countries often warn their companies that Turkmen legislation does not do enough to protect foreign investments.

Darius Regenhardt

Novastan.org writer

For more news and analysis from Central Asia, follow us on Twitter, Facebook, Telegram, Linkedin or Instagram.

Agreement between Azerbaijan and Turkmenistan paves the way for Trans-Caspian Pipeline

Agreement between Azerbaijan and Turkmenistan paves the way for Trans-Caspian Pipeline